Welcome to Seiersen Enterprises

E

Enjoy our blogs here

Sustainable Supply Chain Value Through the Right Deals with the Right Trading Partners

Digitizing the Supply Chain

Check out my blogs on Linkedin: https://www.linkedin.com/in/nicholasseiersen/recent-activity/articles/

Trust & Trading Relationships

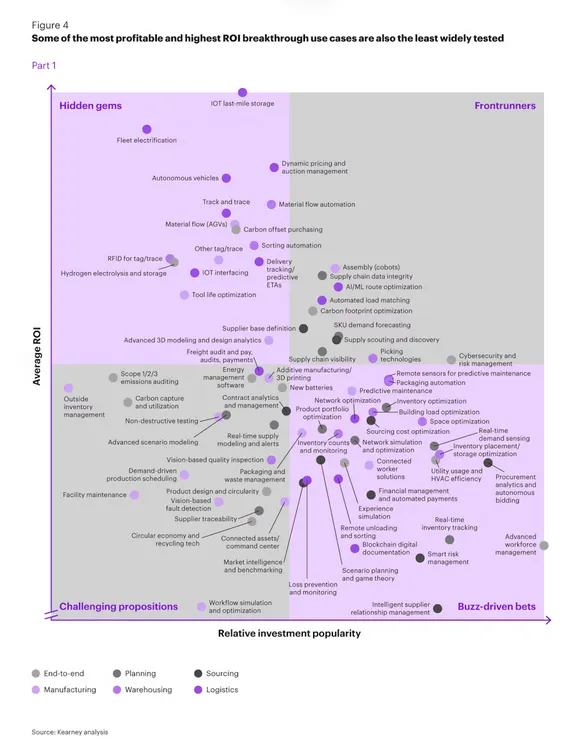

Supply Chain Technologies ROI vs. Buzz Factor

The magic quadrant of this 2x2 matrix is the upper right hand one, the one that is not very populated - high ROI and popular investment.

What is in there?

Robots and automation, namely fleet electrification, sortation, flow automation and AGV

With the recent longshoreman strikes and the compensation concessions made, and the increase in inventory as risk mitigation for the next disruption, material handling certainly looks attractive. Add in increased capabilities on the systems side. But these are big investments, and mean tearing out your existing infrastructure - highly disruptive to operations. To take fleet electrification, it means changing all the vehicles, the parts, the operating & maintenance practices, the energy supply... Big, big "I" and big change. AGV's and sortation have big-bang implementation risk as well. God save us from the low ROI technologies! I can certainly see shop-floor robots, but I couldn't find that on the graph.

Transportation, with route optimization and load matching

With transportation usually about half of logistics costs, these are costs begging to be optimized, and routes are by definition half full. Inbound/outbound matching and weight/cube maximization do not require massive changes, and with quality data, big gains can be secured.

Visibility with tracking & tracing, delivery/proactive ETA, and RFID

These are indeed easy to implement through SaaS offering like OrkestraSCS and a few systems links to suppliers, carriers, and other intermediaries, using EDI type data. The Payback is less obvious: Better customer service (less expediting), more dependable delivery times (less inventory), and better quality control (less spoilage).

SKU level demand forecasting

Forecasts are always wrong, new technologies may make them less wrong.,So with better matching supply to demand, we could have higher sales, lower inventories and less spoilage/obsolescence. Using complex forecasting techniques may be beyond the comfort of many users, which will probably hurt the R in the ROI.

Carbon Footprint

Nice to know what your carbon footprint estimate is. Without a broad carbon trading system, I am not sure where the R is.

Supplier discovery

Probably one of the prime uses of LLMs, can certainly reduce supplier research effort. There are reputable companies that provide this service and stand behind the data they sell. LLMs are known to hallucinate, more so when they cannot find an answer, which is where supplier discovery falls. Proceed with caution, and the R may be elusive.

Cyber/risk management

The R is avoidance of loss, so reducing the certainty and/or magnitude of loss makes a lot of sense. But these Investments transcend the need for Return, they Investment are a must do.

To my mind, many of these high ranking use cases are not very attractive. The payback is difficult or the investment is large and disruptive. Or both. I question the rationale in the ROI evaluation. DHL's technology radar highlights high payback in robots in warehouses and advanced analytics. That definitely passes my sniff test.

The lower right hand quadrant (popular but low ROI - Buzz-driven bets) use-cases are certainly more "sexy": Real-time inventory tracking, Advanced workforce management, Smart risk management, Intelligent supplier relationship management, Blockchain digital documentation.

Most of them are so nebulous as to be meaningless in an ROI perspective.

Which leads me to conclude that looking over the shoulders of others makes very little sense. To work out your supply chain technology strategy and initiatives, you still have to work through your operations and your opportunities, and evaluate their attractiveness in your context.

For more, opt-in to the Digitizing the Supply Chain blogs on this page.

Data Quality

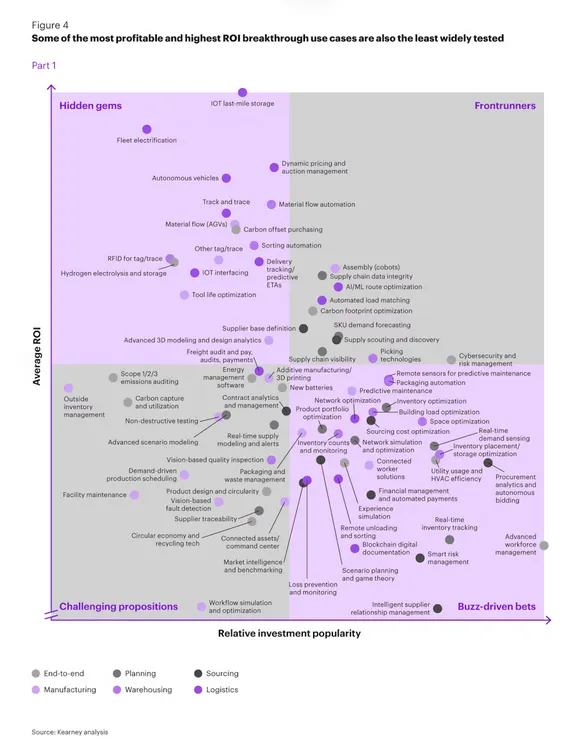

Supply Chain Technologies ROI vs. Buzz Factor

The magic quadrant of this 2x2 matrix is the upper right hand one, the one that is not very populated - high ROI and popular investment.

What is in there?

Robots and automation, namely fleet electrification, sortation, flow automation and AGV

With the recent longshoreman strikes and the compensation concessions made, and the increase in inventory as risk mitigation for the next disruption, material handling certainly looks attractive. Add in increased capabilities on the systems side. But these are big investments, and mean tearing out your existing infrastructure - highly disruptive to operations. To take fleet electrification, it means changing all the vehicles, the parts, the operating & maintenance practices, the energy supply... Big, big "I" and big change. AGV's and sortation have big-bang implementation risk as well. God save us from the low ROI technologies! I can certainly see shop-floor robots, but I couldn't find that on the graph.

Transportation, with route optimization and load matching

With transportation usually about half of logistics costs, these are costs begging to be optimized, and routes are by definition half full. Inbound/outbound matching and weight/cube maximization do not require massive changes, and with quality data, big gains can be secured.

Visibility with tracking & tracing, delivery/proactive ETA, and RFID

These are indeed easy to implement through SaaS offering like OrkestraSCS and a few systems links to suppliers, carriers, and other intermediaries, using EDI type data. The Payback is less obvious: Better customer service (less expediting), more dependable delivery times (less inventory), and better quality control (less spoilage).

SKU level demand forecasting

Forecasts are always wrong, new technologies may make them less wrong.,So with better matching supply to demand, we could have higher sales, lower inventories and less spoilage/obsolescence. Using complex forecasting techniques may be beyond the comfort of many users, which will probably hurt the R in the ROI.

Carbon Footprint

Nice to know what your carbon footprint estimate is. Without a broad carbon trading system, I am not sure where the R is.

Supplier discovery

Probably one of the prime uses of LLMs, can certainly reduce supplier research effort. There are reputable companies that provide this service and stand behind the data they sell. LLMs are known to hallucinate, more so when they cannot find an answer, which is where supplier discovery falls. Proceed with caution, and the R may be elusive.

Cyber/risk management

The R is avoidance of loss, so reducing the certainty and/or magnitude of loss makes a lot of sense. But these Investments transcend the need for Return, they Investment are a must do.

To my mind, many of these high ranking use cases are not very attractive. The payback is difficult or the investment is large and disruptive. Or both. I question the rationale in the ROI evaluation. DHL's technology radar highlights high payback in robots in warehouses and advanced analytics. That definitely passes my sniff test.

The lower right hand quadrant (popular but low ROI - Buzz-driven bets) use-cases are certainly more "sexy": Real-time inventory tracking, Advanced workforce management, Smart risk management, Intelligent supplier relationship management, Blockchain digital documentation.

Most of them are so nebulous as to be meaningless in an ROI perspective.

Which leads me to conclude that looking over the shoulders of others makes very little sense. To work out your supply chain technology strategy and initiatives, you still have to work through your operations and your opportunities, and evaluate their attractiveness in your context.

For more, opt-in to the Digitizing the Supply Chain blogs on this page.

Other Supply Chain Topics

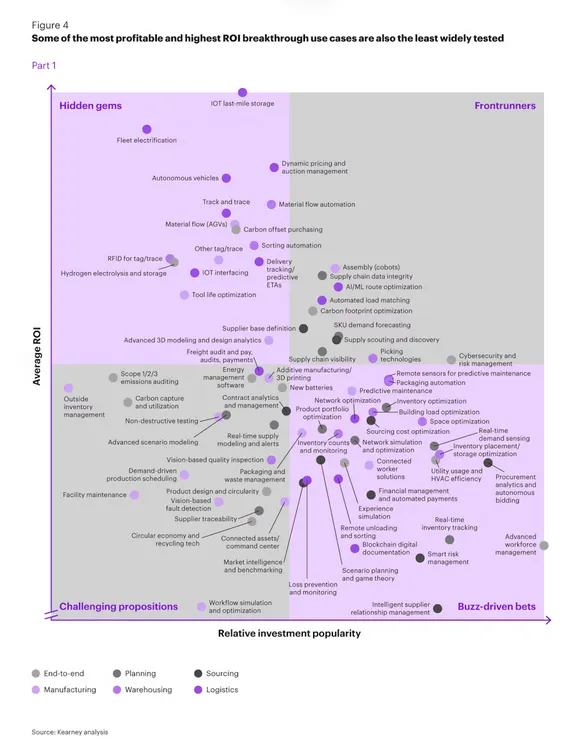

Supply Chain Technologies ROI vs. Buzz Factor

The magic quadrant of this 2x2 matrix is the upper right hand one, the one that is not very populated - high ROI and popular investment.

What is in there?

Robots and automation, namely fleet electrification, sortation, flow automation and AGV

With the recent longshoreman strikes and the compensation concessions made, and the increase in inventory as risk mitigation for the next disruption, material handling certainly looks attractive. Add in increased capabilities on the systems side. But these are big investments, and mean tearing out your existing infrastructure - highly disruptive to operations. To take fleet electrification, it means changing all the vehicles, the parts, the operating & maintenance practices, the energy supply... Big, big "I" and big change. AGV's and sortation have big-bang implementation risk as well. God save us from the low ROI technologies! I can certainly see shop-floor robots, but I couldn't find that on the graph.

Transportation, with route optimization and load matching

With transportation usually about half of logistics costs, these are costs begging to be optimized, and routes are by definition half full. Inbound/outbound matching and weight/cube maximization do not require massive changes, and with quality data, big gains can be secured.

Visibility with tracking & tracing, delivery/proactive ETA, and RFID

These are indeed easy to implement through SaaS offering like OrkestraSCS and a few systems links to suppliers, carriers, and other intermediaries, using EDI type data. The Payback is less obvious: Better customer service (less expediting), more dependable delivery times (less inventory), and better quality control (less spoilage).

SKU level demand forecasting

Forecasts are always wrong, new technologies may make them less wrong.,So with better matching supply to demand, we could have higher sales, lower inventories and less spoilage/obsolescence. Using complex forecasting techniques may be beyond the comfort of many users, which will probably hurt the R in the ROI.

Carbon Footprint

Nice to know what your carbon footprint estimate is. Without a broad carbon trading system, I am not sure where the R is.

Supplier discovery

Probably one of the prime uses of LLMs, can certainly reduce supplier research effort. There are reputable companies that provide this service and stand behind the data they sell. LLMs are known to hallucinate, more so when they cannot find an answer, which is where supplier discovery falls. Proceed with caution, and the R may be elusive.

Cyber/risk management

The R is avoidance of loss, so reducing the certainty and/or magnitude of loss makes a lot of sense. But these Investments transcend the need for Return, they Investment are a must do.

To my mind, many of these high ranking use cases are not very attractive. The payback is difficult or the investment is large and disruptive. Or both. I question the rationale in the ROI evaluation. DHL's technology radar highlights high payback in robots in warehouses and advanced analytics. That definitely passes my sniff test.

The lower right hand quadrant (popular but low ROI - Buzz-driven bets) use-cases are certainly more "sexy": Real-time inventory tracking, Advanced workforce management, Smart risk management, Intelligent supplier relationship management, Blockchain digital documentation.

Most of them are so nebulous as to be meaningless in an ROI perspective.

Which leads me to conclude that looking over the shoulders of others makes very little sense. To work out your supply chain technology strategy and initiatives, you still have to work through your operations and your opportunities, and evaluate their attractiveness in your context.

For more, opt-in to the Digitizing the Supply Chain blogs on this page.